Climate Change in Australia

Climate information, projections, tools and data

Step 1: Understand Context

Guidance Step 1

(pdf 560.8 KB)

- Overview

- What is at risk?

- What climate hazards are important?

- Who is interested or affected?

- What would you like the risk assessment to achieve?

- Document the process

- Iterative nature of climate risk assessments

- References

- Downloads

Overview

Climate variability and change present a risk to the electricity sector now and in the future. Risk from climate change is defined as the combination of hazard (e.g. changes in the weather), exposure (e.g. asset location) and vulnerability (e.g. the likelihood that the asset will be damaged or not function). The ESCI project recommends a five-step approach to climate risk assessment that starts with establishing the context. This involves:

- identifying climate-related decisions or questions

- conducting a quick scan to confirm which climate hazards are most important

- identifying internal and external stakeholders who can contribute and/or should be involved in decision-making

- defining the purpose of the risk assessment—this will help define the scope and key metrics for evaluating risk and will guide the selection of the appropriate future climate scenario

What is at risk?

The ESCI Climate Risk Assessment Framework supports high-level decisions such as corporate strategic direction, or system-wide assessments on investing for resilience to extreme weather events.

The Framework (Figure 1) can also be applied to activities such as developing maintenance plans for a particular asset class.

The first step is to identify if the activities under consideration are at risk from a changing climate.

Figure 1 The ESCI Climate Risk Assessment Framework.

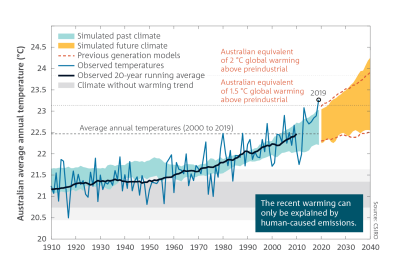

Weather is the state of the atmosphere on short timescales, from seconds to days. Climate is the average weather, usually considered over 20–30 years to allow for year-to-year variability (see Figure 2). Climate change is having a significant influence on weather, especially extreme weather events.

Weather and electricity are interconnected. Weather is the 'fuel' for solar, wind and hydro-electricity generation and electricity demand is strongly dependent on temperature. Electricity infrastructure performance is affected by extreme events such as high temperatures, droughts and severe winds. Climate risk should therefore be considered as part of:

- System reliability. The behaviour of systems and networks changes when weather is outside normal operating conditions. For example, decreasing soil moisture could have an impact on the ability of underground power lines to carry specified current.

- Investment cases if projected asset performance changes significantly. For example, projected rainfall decreases may affect the business case for new hydro-generation assets.

- System resilience. Compound and extreme weather events are increasing in frequency and magnitude, threatening assets and whole-of-system performance. For example, the increasing frequency of extreme bushfires may require a reassessment of maintenance or operating practices.

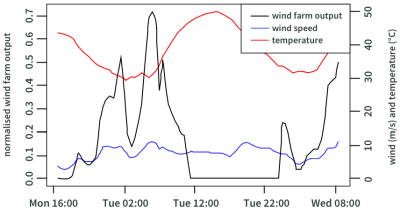

Figure 3 provides an ESCI project example of the risk extreme heat poses to variable renewable energy. The figure shows the relationship between wind farm output (black line), wind speed (blue line) and temperature (red line) during a very hot day. The wind farm shuts down during peak demand (and peak pricing) hours from 12 pm. This behaviour could change the investment case for the wind farm.

Figure 2. Australian average temperature observed and simulated from climate models. Past and future bands show the range of 20-year running average of climate model outputs. (Source: BoM & CSIRO 2020 State of the Climate)

Figure 3 Impact of high temperatures on wind farm output for an Australian wind farm. As temperatures increase, electricity demand tends to rise, but with extreme high temperatures wind farm output may decrease. (Source: ESCI case study—extreme heat & VRE)

WHAT CLIMATE HAZARDS ARE IMPORTANT?

Climate change is likely to increase some risks significantly as both weather hazards and exposure may change.

A scan should be undertaken for areas, processes and assets that could be affected by a changing climate (see Table 1); this provides a rapid, first-pass appraisal of the main climate risks, identifies priorities for further work and indicates whom to involve.

Climate data and analyses need not be considered at this point, just high-level summaries such as regional tables or maps of climate change (NESP 2020) (see sidebar on climate information products useful for identifying climate hazards). Past climate-related impacts will also provide guidance on important hazards.

Consider creating a simple table that lists

- historical climate hazards and impacts

- projected changes in hazards, exposure and vulnerability over the next 30–80 years

- future risks

- potential risk mitigation options

ESCI case studies (available here ) provide examples of climate risk assessments for electricity system assets, processes or system decisions. Asset and operation locations are unique and can only be assessed on a case-by-case basis. However, the case studies can help identify climate-sensitive decisions.

The risk identification process is best run as a brainstorming session among a group of diverse stakeholders who understand the interdependencies within and between operations, assets, weather and climate.

Table 1 Examples of climate hazards for different components of the electricity sector, and relevant case studies

Component | Hazard | ESCI case study |

|---|---|---|

Assets for distribution and transmission | Bushfire, extreme temperature and severe convective wind Reduced soil moisture (increases impedance and reduces thermal conductivity) | Bushfire risk Severe convective wind risk Soil moisture variability Extreme heat risk |

Solar or wind power generation | Extreme heat, changes in solar irradiation and wind | Extreme heat risk |

Hydro power generation | Reduced streamflow into dams | Streamflow variability |

Thermal coal power generation | Extreme heat, causing over-heating of cooling water and reduced supply | |

AEMO system reliability modelling | Extreme temperatures, affecting all aspects of supply | Extreme heat risk Bushfire risk Streamflow variability Compound extreme events |

AEMO electricity demand modelling | Heatwaves and extreme temperatures (may change patterns of demand) | Temperature variability |

Impacts on communities | Bushfires Hailstorms and floods Extreme and compound climate events | Bushfire risk (distributed energy resources) Compound extreme events |

WHO IS INTERESTED OR AFFECTED?

Climate change will affect both internal and external stakeholders, therefore both should be engaged early in the process to ensure that the risk assessment meets all needs and considers all aspects of risk and opportunity.

Internal Stakeholders

You should gather information from different functional areas of the organisation, based on the aim of the risk assessment.

Consider:

- technical experts to provide information on engineering specifications or maintenance schedules

- quantitative expertise if the team expects to do a 'deep dive' into detailed climate informationinvestment or policy questions will require relevant internal experts

- technical and strategic expertise to explore future network mitigation options

Senior managers or executives may already be considering climate change, for example, as part of a net zero emissions or risk mitigation plan, so decision-makers should be engaged to ensure that their needs and expectations are met. If climate risk is still in the early stages of discussion, you may need to provide additional background information.1

External Stakeholders

There are a range of external stakeholders who should be considered at the beginning of your climate risk assessment.

If the decision includes a large network investment, the Australian Energy Regulator will be a key stakeholder. When using climate change information, consider engaging with the regulator to ensure that they agree with the approach, including the way in which confidence and uncertainty in the climate projections are expressed.

Investment analysis decisions may be triggered by proposed rules and advice from the Australian Energy Market Commission (particularly regarding their objective of maintaining system security and wholesale electricity reliability).

State pricing and regulatory authorities (e.g. IPART and ESC) may need to be involved given their focus on retail network pricing and regulation.

Climate risk is a system risk and so AEMO and other market participants may respond to changing conditions in a way that has an impact on ranking the adaptation options.

There may be other organisations such as Energy Networks Australia that have conducted similar risk assessments and could be an excellent source of advice.

Financial institutions are encouraged, and increasingly expected, to disclose climate-related risk in projects they support so they should be considered as stakeholders.2,3,4

Insurers are particularly concerned about the increasing severity and frequency of extreme weather events. An organisation demonstrating that they have considered and itigated climate risk in their asset and system management practices or investments may obtain reduced premiums to protect against climate hazards.

Retailers and consumers are important stakeholders, so you should consider how to engage them early in the risk assessment.

WHAT WOULD YOU LIKE THE RISK ASSESSMENT TO ACHIEVE?

Consider the drivers for the risk assessment. While future system performance may be the primary focus of a climate risk assessment, there may be other motivating factors. For example, are you complying with a directive from management to consider climate risk? Are you responding to interest and pressure from external stakeholders? The World Economic Forum (2021) ranks weather and climate risk among the highest likelihood and impact global risks (see Figure 4), which is resulting in increased scrutiny from inside and outside companies.

A meeting with key stakeholders may reveal additional objectives. Is there an immediate sense of urgency to address climate risks because impacts are already apparent? If so, list some examples of climate hazards and impacts. Are there potential opportunities in a changing climate?

Figure 4 In 2020, the World Economic Forum Global Risks Report put extreme weather and climate change risk at the top of its most likely, and highest, world economic impacts. (Modified from World Economic Forum 2021 , Fig II, p.12)

Being clear about goals and objectives will help to determine the metrics that will be used to assess the risk (Step 2), the climate scenario(s) to explore (Step 3), and potential risk treatment options (Step 5).

DOCUMENT THE PROCESS

It is important to document the discussion and key decisions. Climate risk assessments will need to be revisited as the science improves and as the economic, technological, demographic and political landscape changes. Careful documentation is also important to support the legitimacy of stakeholder consultation.

ITERATIVE NATURE OF CLIMATE RISK ASSESSMENTS

A climate risk assessment conducted on a decision today will need to be repeated from the beginning the next time that decision is assessed.

Climate projections are based on global climate models that are regularly updated. These coordinated efforts are part of the Coupled Model Intercomparison Project (CMIP), supported by the World Climate Research Program. The ESCI project climate information products are based on CMIP Phase 5 climate models, with new climate models being assessed in CMIP Phase 6. As these new models become available, the climate information provided by ESCI will still be relevant but new information should be assessed.

Finally, the National Electricity Market is dynamic; although AEMO's Integrated System Plan (ISP) takes a 20-year view of the NEM, the ISP is reissued every two years as the grid evolves in response to policy, economic, population and technology changes. These changes should be included in climate risk assessments.

REFERENCES

BoM and CSIRO (2020). State of the Climate

NESP (2020). Scenario analysis of climate-related physical risks for buildings and infrastructure: climate science guide

World Economic Forum (2021). The Global Risks Report 2021 (16th edition) A report by the World Economic Forum in partnership with Marsh McLennan, SK Group and Zurich Insurance Group

Notes

1 The ESCI project has created communications material that can be used with senior executives and board members (available here ).

2 Climate-Related and Other Emerging Risks Disclosures: Assessing Financial Statement Materiality Using AASB Practice Statement 2 (AASB, AUASB, 2018).

3 The Task Force on Climate-related Financial Disclosure (TCFD) provides a framework and recommendations on disclosing financial risk TCFD (2017). Recommendations of the Task Force on Climate-related Financial Disclosures. Task Force on Climate-related Financial Disclosures.

4 Financial Conduct Authority (2020) Proposals to Enhance Climate-Related Disclosures by Listed Issuers and Clarification of Existing Disclosure Obligations. Policy Statement PS20/17. Financial Conduct Authority, UK.

Downloads

DownloadGuidance Step 1 and all figures (zip 1023.9 KB)